Investors

Diversified exposure to the world’s leading copper mines

- Portfolio of interests in low-cost, high-quality copper mines

- Cash-flows levered to rising copper prices

- Built-in growth and significant financing flexibility for future acquisitions

TSX.V: HCU

OtcqB: HNCUF

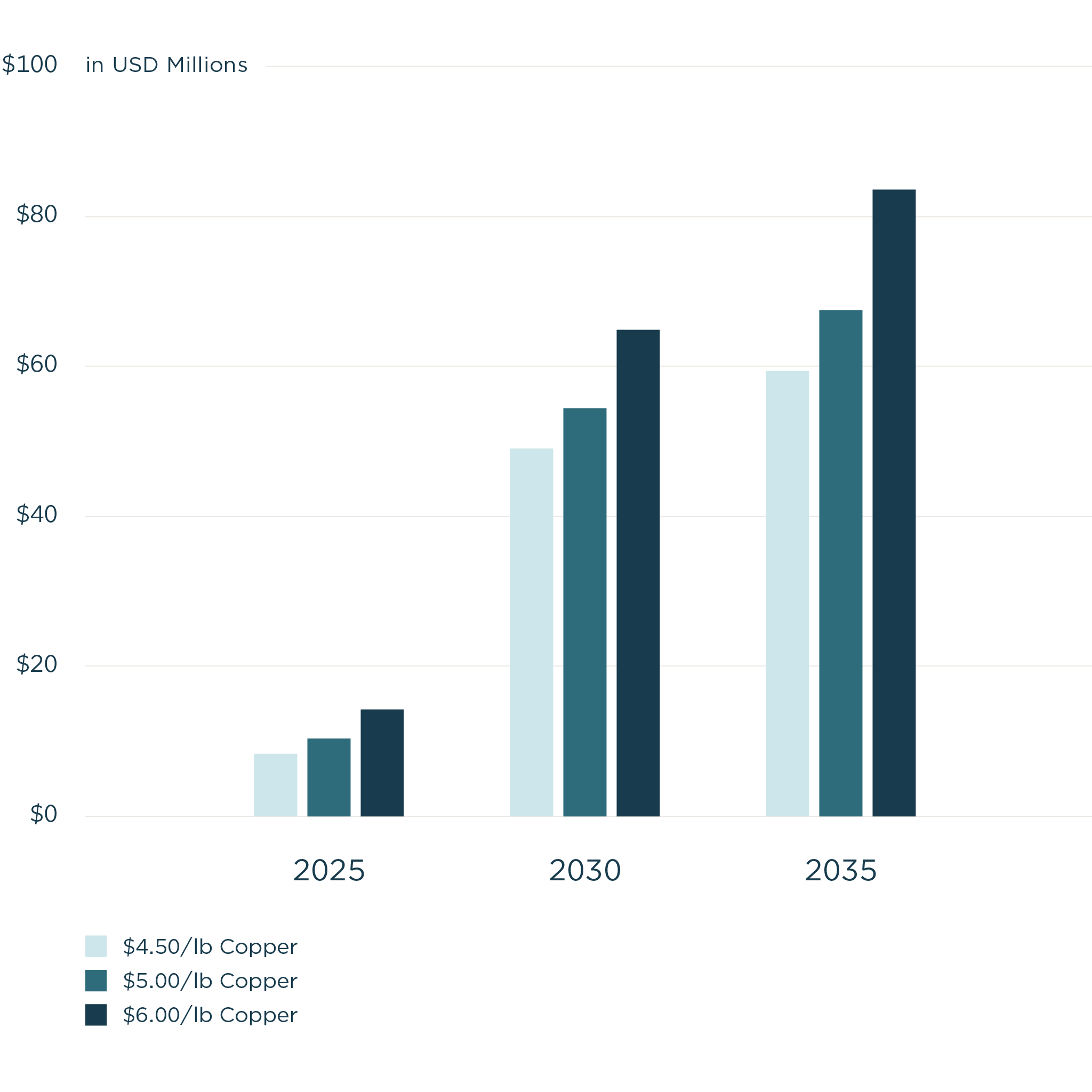

Built-in Growth with Leverage to Rising Copper Prices

Horizon ADJUSTED EBITDA1

Gold $2600/oz, Silver: $30/oz

Built-in Growth with Leverage to Rising Copper Prices

Horizon’s inaugural portfolio consists of a collection of world-renowned, low-cost copper mining projects that are expected to generate cash flow for multiple decades. Horizon’s portfolio has a pathway to grow to over $80M by 2035 in attributable EBITDA1.

1. Attributable EBITDA equals adjusted EBITDA net of Hod Maden and Antamina obligations to Sandstorm Gold Royalties.

Horizon’s inaugural portfolio consists of a collection of world-renowned, low-cost copper mining projects that are expected to generate cash flow for multiple decades. Horizon’s portfolio has a pathway to grow to between $70–$100M by 2032 in attributable EBITDA1.

1. Adjusted EBITDA attributable to Horizon Copper net of Hod Moden and Antamina stream obligations to Sandstorm Gold Royalties

Unparalleled Copper Portfolio

Antamina

1.66% Net Profits Interest1

The world’s 3rd largest copper mine2.

Oyu Tolgoi

24% Equity Interest in Entreé

Entreé Resources is a public company that holds a unique 20% joint venture carried interest on the Hugo North Extension at Oyu Tolgoi.

Oyu Tolgoi

25% Equity Interest in Entreé

Entreé Resources is a public company that holds a unique 20% joint venture carried interest on the Hugo North Extension at Oyu Tolgoi.

Hod Maden

30% Non-Operating Interest3

One of the best copper-gold development projects in the world.

1. Before Antamina Silver Stream servicing and Sandstorm Antamina Residual Royalty payment.

2. S&P Global: 2023 actual production of top global copper mines on copper equivalent basis.

3. Less Gold Stream payable to Sandstorm Gold Royalties.

Key Catalysts for Asset Re-Rating

Antamina

- Throughput expansion

- Extended Reserve life to 2036

Oyu Tolgoi (Hugo North Extension)

- Hugo North development

- First production at Hugo North Extension

- First cash flows to Entrée shareholders

Hod Maden

- Construction decision and development milestones

- First production

- Exploration and Resource expansion of South Zone

Horizon in the Media

Watch recently posted Horizon Copper news stories, interviews, and video content to make sure you don’t miss a beat. Visit Horizon Copper’s YouTube Channel for more videos.

Horizon COpper

Investor Presentation with Erfan Kazemi

Horizon Copper is well-positioned to take advantage of rising copper prices over the next decade. With diversified exposure to the world’s leading copper mines, Horizon Copper is an investment like no other. Hear from President & CEO, Erfan Kazemi, discuss Horizon’s portfolio and existing growth profile.

Analyst Coverage

| Institution | Name | Phone | |

|---|---|---|---|

| National Bank Financial | Shane Nagle | shane.nagle@nbc.ca | (416) 869-7936 |

Financials Results

For all previously reported financial results, please refer to Horizon Copper’s SEDAR+ issuer profile at www.sedarplus.ca

AGM and Corporate Materials

Horizon Copper will hold its Annual General Meeting of Shareholders on Friday, May 30, 2025 at 1:00pm in Vancouver, British Columbia, Canada. Meeting materials for the 2025 AGM are available as viewable PDFs in the links below, along with the Annual Information Form for the year ended December 31, 2024.

Questions?

We’ve provided answers to common inquiries from our shareholders and potential investors about our company and the copper industry.

Faqs